August News Letter 2025

News Letter for August 2025

The Rise of Direct-Pay Healthcare Models

In a healthcare landscape often defined by complex insurance systems and opaque billing practices, a more direct approach known as "cash-pay" or direct-pay healthcare is gaining attention. This model, where patients compensate providers directly without an insurance intermediary, offers a different framework for managing healthcare costs and services. While bypassing insurance may seem counterintuitive, several factors are leading a growing number of individuals to consider this option, particularly as the dynamics of healthcare policy and costs continue to shift.

Key Aspects of Cash-Pay Healthcare

1. Price Transparency A primary characteristic of the cash-pay model is its emphasis on price transparency. In a typical insurance-based transaction, patients may encounter a series of charges—co-pays, deductibles, and other fees—that can obscure the true cost of care until an Explanation of Benefits is received long after a service is provided. The cash-pay model seeks to eliminate this uncertainty. Patients are generally informed of the exact cost of a service upfront, allowing them to make clear, informed financial decisions about their treatment options without the concern of unexpected future bills.

2. Potential for Cost Savings Beyond transparency, direct payment can sometimes result in significant cost savings. This is particularly true for individuals with high-deductible health plans or those without any insurance coverage. For certain procedures, lab tests, or prescriptions, the cash price offered by a provider can be substantially lower than the total amount a patient might pay after navigating the deductibles and cost-sharing requirements of their insurance plan. A study from the Johns Hopkins Bloomberg School of Public Health found that cash prices offered by hospitals were frequently lower than the prices negotiated with insurers, highlighting a market dynamic where direct payment can lead to more favorable rates.

3. Reduced Administrative Load Direct-pay models can significantly simplify the healthcare process by stripping away the administrative layers associated with insurance billing. The conventional system often involves extensive paperwork, pre-authorizations for treatment, and the use of complex billing codes to process claims. A cash-based system can streamline these operations for both parties. For providers, this means less time and resources are spent on administrative tasks, allowing for a greater focus on patient care. For patients, it results in a more straightforward and less cumbersome healthcare experience.

4. Increased Provider Choice and Flexibility Patients who pay for services directly are not constrained by the limitations of an insurance company's provider network. This freedom opens up a wider range of care options, allowing individuals to select doctors, specialists, and services that best align with their specific health needs and personal preferences. This autonomy is especially valuable for those seeking specialized care or wishing to engage with alternative practice models like Direct Primary Care (DPC), where a direct financial relationship with a primary care physician fosters a more personalized and continuous approach to health management.

5. The Patient-Provider Relationship By reducing the administrative burdens placed on providers by insurance companies, the cash-pay model can help foster a stronger patient-provider relationship. When clinicians are not consumed by billing and claims processing, they often have more time to dedicate to each patient. This can lead to more thorough consultations, a deeper understanding of a patient's condition, and a more collaborative treatment plan. The financial transparency and direct interaction inherent in the model can build a foundation of trust and improve communication, enhancing the overall quality of the healthcare experience.

The Affordable Care Act (ACA) and Rising Premiums

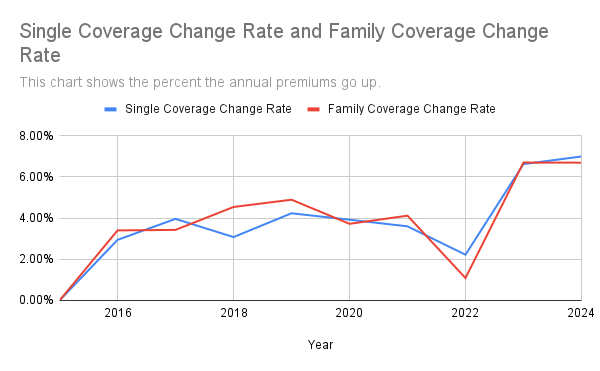

The conversation around cash-pay healthcare is increasingly relevant when viewed against the backdrop of the evolving Affordable Care Act (ACA) marketplace. Projections for 2026 indicate a potential for significant increases in ACA premiums, which could present challenges for many enrollees.

A primary driver of this anticipated trend is the scheduled expiration of enhanced premium tax credits at the end of 2025. These subsidies, first expanded by the American Rescue Plan and later extended by the Inflation Reduction Act, have played a crucial role in lowering out-of-pocket premium costs. Policy experts estimate that without a renewal of these credits, the average amount individuals pay for coverage could rise dramatically. This not only impacts affordability for current beneficiaries but also raises concerns that healthier individuals might opt out of coverage, potentially leading to a more costly and less stable insurance pool.

In addition to the expiring subsidies, insurers are requesting median premium increases of around 15% for 2026, citing underlying medical costs, including the use of expensive new drugs. This combination of factors is prompting some consumers to evaluate alternative methods for managing their healthcare expenses. While the cash-pay model is not a universal solution, particularly for catastrophic medical events or complex chronic conditions, its appeal as a transparent and potentially cost-effective option is growing as individuals navigate the increasing financial pressures of traditional insurance plans.

A Shift Toward Patient Empowerment

Ultimately, the growing interest in cash-pay healthcare reflects a broader desire among consumers for greater clarity, control, and value in their medical care. It is not positioned to replace the insurance system, which remains essential for managing high-cost, unexpected, and chronic health issues. Instead, the direct-pay model is emerging as a valuable component within a more diverse healthcare ecosystem.

As patients become more proactive in managing both their health and their finances, models that prioritize transparency, direct relationships, and administrative simplicity will likely continue to gain traction. The rise of cash-pay is less a rejection of insurance outright and more a signal of a fundamental shift—a move toward a system where empowered patients can make informed choices that best suit their individual needs, creating a more balanced and responsive healthcare landscape for the future.

All Rights Reserved | American Medical Plans

Sources:

- Bai, G., Wang, Y., et al. (2023). The Relationships Among Cash Prices, Negotiated Rates, And Chargemaster Prices For Shoppable Hospital Services. Health Affairs, 42(4).

https://pubmed.ncbi.nlm.nih.gov/37011313/

- KFF. (2025, August 4). Health Provisions in the 2025 Federal Budget Reconciliation Law.

- Cox, C., et al. (2025, August 6). How Much and Why ACA Marketplace Premiums Are Going Up in 2026. Peterson-KFF Health System Tracker.

- KFF. (2025, August 8). KFF analysis finds a median ACA premium hike of 18% for 2026.

https://www.fiercehealthcare.com/payers/kff-analysis-finds-median-aca-premium-hike-18-2026

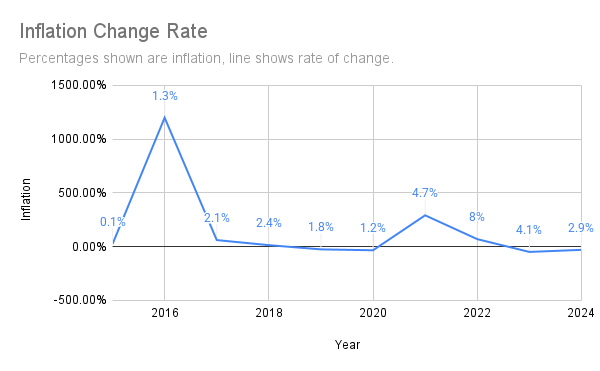

- U.S. Bureau of Labor Statistics, Inflation Percentages (2025, August 19)