October 2025 Newsletter: Getting Ready for Open Enrollment

Getting Ready for Open Enrollment

Open Enrollment is starting up. This is your annual opportunity to choose or change your health insurance plan for the upcoming year. Making the right choice can save you money and ensure you have the coverage you need. Here’s how to get ready for open enrollment in 2025.

What is Open Enrollment?

Open enrollment is a specific window of time each year when you can sign up for a new health insurance plan or make changes to your existing one. Whether you get insurance through your job, the Affordable Care Act (ACA) Marketplace, or Medicare, this is your primary chance to make adjustments. If you miss this window, you generally can't enroll in a new plan until the next open enrollment period unless you experience a qualifying life event, like getting married or losing other health coverage.

Mark Your Calendar: Key 2025 Dates

While dates can vary, especially for employer-sponsored plans, here are the typical open enrollment periods to watch for:

- Affordable Care Act (ACA) Marketplace: The federal Marketplace (HealthCare.gov) open enrollment period starts on November 1st, and ends on January 15th.

- Employer-Sponsored Plans: Most companies hold their open enrollment in the fall, often during October or November, for coverage starting January 1. Check with your HR department for your company's exact dates.

- Medicare: The Medicare Annual Enrollment Period runs from October 15, 2025, to December 7, 2025. This is the time for beneficiaries to change their Medicare Advantage or Part D prescription drug plans.

- Marketplace Coverage Effective Date: If you’ve changed, or just enrolled in, a marketplace plan, your first premium and coverage period starts on February 1st.

Your 5-Step Preparation Checklist

Don't wait until the deadline is looming. A little preparation can make the process smooth and stress-free.

- Review Your Current Coverage: Think about the past year. Were you happy with your plan? Did it cover your doctors and prescriptions? Were the out-of-pocket costs manageable? Note what worked and what didn't.

- Anticipate Next Year's Needs: Consider any life changes on the horizon. Are you planning to have a baby, expecting a change in income, or managing a new health condition? Your future needs are a key factor in choosing the right plan.

- Gather Your Information: Have the essentials ready for everyone you're enrolling. This includes Social Security numbers, birth dates, and recent income information (like pay stubs or W-2s).

- Know the Lingo: Understanding key terms is crucial for comparing plans.

- Premium: The fixed amount you pay each month for coverage.

- Deductible: The amount you must pay for covered services before your insurance starts to pay.

- Copay: A fixed amount you pay for a covered service, like a doctor's visit.

- Coinsurance: The percentage of costs you pay for a covered service after you've met your deductible.

- Out-of-Pocket Maximum: The most you'll have to pay for covered services in a plan year. After you hit this amount, your insurance pays 100%.

- PPO: Proffered provider network. This means the plan will cover any doctor you may choose to go to.

- HMO: Health maintenance organization. This means you'll have a set list of doctors that are contracted with your plan.

- Set Your Budget: Look beyond the monthly premium. A plan with a low premium might have a high deductible, meaning you'll pay more upfront for care. Calculate what you can realistically afford for both monthly payments and potential out-of-pocket expenses.

Making Your Final Choice

Once you've done your homework, it's time to compare your options.

- Check the Network: Make sure your preferred doctors, hospitals, and specialists are "in-network" to avoid high out-of-network costs.

- Verify Prescription Coverage: Use the plan's drug formulary (list of covered medications) to ensure your prescriptions are covered at a reasonable cost.

- Look at Total Costs: Don't just pick the plan with the lowest premium. Consider the deductibles, copays, and out-of-pocket maximum to estimate your total potential cost for the year.

- Don't Be Afraid to Ask for Help: If you're using the ACA Marketplace, free help is available from certified assisters or "navigators." If you're choosing a plan through work, your HR department is your best resource.

Open-Enrollment Alternatives

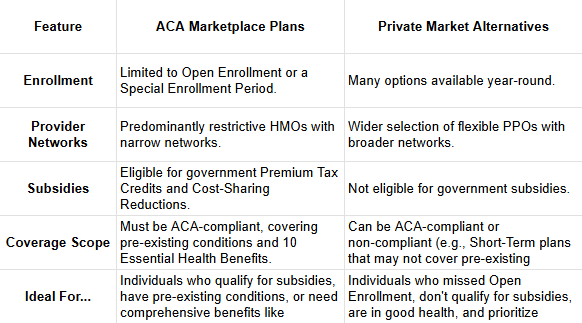

1. The Enrollment Window: Open Enrollment vs. Year-Round Access

- ACA Marketplace Plans (Relying on Open Enrollment): These are the plans available through government exchanges like HealthCare.gov. Enrollment is restricted to the annual Open Enrollment Period (OEP), typically from November 1st to January 15th in most states. The only way to enroll outside of this window is if you have a Qualifying Life Event (QLE), such as losing your job, getting married, or moving, which grants you a Special Enrollment Period (SEP).

- Private Market Alternatives: Many plans sold directly by insurance companies or through private brokers are available for purchase year-round. This is a significant advantage for individuals who miss the OEP and do not have a QLE. This category includes everything from fully ACA-compliant plans sold "off-exchange" to other types of coverage like Short-Term Medical plans. This directly addresses your point about being "able to make changes to your coverage throughout the year."

2. Provider Networks: The PPO vs. HMO Dominance

This is one of the most significant distinctions and a major driver of consumer choice.

- PPO (Preferred Provider Organization): This type of network offers the most flexibility. You can see any doctor you wish, both in-network and out-of-network. You don't need a referral from a primary care physician (PCP) to see a specialist. While staying in-network is cheaper, you still have coverage (at a higher cost) if you go out-of-network.

- HMO (Health Maintenance Organization): This network is more restrictive and generally more affordable. You must use doctors, hospitals, and specialists within its network (except in an emergency). You are also typically required to have a PCP who must give you a referral before you can see a specialist.

Why the Difference?

- Marketplace Plans are Predominantly HMOs: To keep premiums affordable, especially for those receiving government subsidies, Marketplace plans often rely on narrower, more restrictive HMO networks. This allows insurers to control costs by negotiating lower rates with a specific set of providers. While PPOs exist on the Marketplace, they are far less common and are often significantly more expensive.

- Private Plans Offer More PPOs: The private market caters to a wider range of consumers, including those who do not qualify for subsidies and are willing to pay a higher premium for greater freedom of choice. Therefore, you will find a much broader selection of PPO plans when shopping directly from an insurer or with a broker. This is ideal for people who travel frequently, want to keep their specific doctor who may not be in an HMO, or simply want direct access to specialists.

3. Plan Design and Suitability

Your statement correctly notes that private plans can be particularly helpful for those in good health. This is because many year-round private options are not ACA-compliant.

- ACA-Compliant Plans (On or Off the Marketplace): By law, these plans must cover pre-existing conditions and provide 10 Essential Health Benefits (e.g., maternity care, mental health services, prescription drugs). They have no annual or lifetime coverage limits. This comprehensive nature makes them essential for anyone with ongoing health concerns.

- Non-ACA-Compliant Private Plans (e.g., Short-Term Medical): These plans are a common alternative found on the private market.

- Good for the Healthy: They are medically underwritten, meaning you can be denied based on your health history. Because they don't have to cover the 10 Essential Health Benefits and can exclude pre-existing conditions, their premiums are often much lower. This makes them an attractive, budget-friendly option for healthy individuals who primarily want protection against unforeseen accidents or new illnesses.

The Trade-Off: The lower cost comes with greater financial risk. These plans often have coverage caps, limited prescription drug benefits, and will not cover any treatment related to a condition you had before you enrolled.

All in all, your insurance needs are not the same as the next person's. The best way to find a plan that could help you is to contact an agent and let them know exactly what your looking for. They'll be able to find you plans and mold your benefits into what exactly works for you.

Author: Quinn Lewis,

Media Manager at American Medical Plans

© 2025

All Rights Reserved | American Medical Plans

Coverage for pre-existing conditions. (n.d.). HealthCare.gov. Retrieved September 16, 2025, from https://www.healthcare.gov/coverage/pre-existing-conditions/

Glossary. (n.d.). HealthCare.gov. Retrieved September 16, 2025, from https://www.healthcare.gov/glossary/

Open Enrollment Dates. (n.d.). HealthCare.gov. Retrieved September 16, 2025, from https://www.healthcare.gov/quick-guide/dates-and-deadlines/

Robinson, K. M. (2025, July 30). HMO vs. PPO: What’s the Difference? WebMD. Retrieved September 16, 2025, from https://www.webmd.com/health-insurance/hmo-vs-ppo